st louis county personal property tax rate

Currently personal property is assessed at 333 of its real value. Missouris most populous county St.

Online Payments And Forms St Louis County Website

Taxes are imposed on the assessed value.

. Louis County collects on average 125 of a propertys assessed fair market value as property tax. Search by Account Number or Address. Property tax rates are amounts per 100 of assessed value on a piece of property.

Locate print and download a copy of your marriage license. Payment can be made through checks or money orders sent to the Revenue Collector 41 South Fifth Avenue. Louis County Commercial Real Estate has an additional commercial surcharge of 170 per 10000 Assessed Valuation.

Louis County has the highest property tax rate of any county in Missouri. Currently personal property is. Originally built in 1894 it served the African-American community until 1931.

You can pay your current year and past years as well. 15000 market value 3 5000 assessed value. Additional methods of paying property taxes can be found at.

Address Collector of Revenue Office St. LOUIS COUNTY MO November 10 2021 - Personal Property and Real Estate tax bills for 2021 will soon arrive is mailboxes for St. Louis County said the phaseout would shift the tax burden to lower-income real property owners.

All Personal Property Tax payments are due by December 31st of each year. Vehicle values are based on the average trade-in value as published by the National Automobile Dealers Association RSMo 1371159 wwwmogamogov. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st.

The assessment is made as of January 1 for the current years tax and is predicated on 33 13 of true value. Leave this field blank. Learn more about this Historic Schoolhouses move.

To declare your personal property declare online by April 1st or download the printable forms. Its quick and easy. Personal Property Tax Rate.

Commercial real property however includes an additional sur tax of 164 per 100 of assessed value. This rate applies to personal property as well as real property. Louis County said the phaseout would shift the tax burden to lower-income real property owners.

It also has quite a high median home value at 190100. The countys average effective property tax rate is 138 well above both state and national averages. Louis County residents and the county is encouraging people to avoid the line and pay online.

Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes. Doug Beck D-south St. Louis County Missouri is 2238 per year for a home worth the median value of 179300.

Place funds in for an inmate in the St. This historic school building was recently rediscovered and is being acquired by the Foundation to be moved and restored in the Historic Village of Faust Park. Louis taxpayers with tangible property are mandated by State law to file a list of all taxable tangible personal property by April 1st of each year with the Assessors Office.

Personal property is assessed at 33 and one-third percent one third of its value. Doug Beck D-south St. Mail payment and Property Tax Statement coupon to.

Part of the southeast quarter of northwest quarter se14 of. Eigels proposal would annually lower the percentage at which. Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year.

Historic African American Schoolhouse Moving to Faust Park. Residents can pay their Personal Property and Real Estates taxes through our Online Tax Payment portal. Legal description of property.

The median property tax also known as real estate tax in St. The median property tax in St. Louis County Assessors Office is responsible for accurately classifying and valuing all property in a uniform manner.

Assessor - Personal Property Assessment and RecordsAssessor - Real Estate Assessment and AppraisalAssessor - Real Estate Records Summary Provides formulas used to calculate personal property residential real property and commercial real property. We look forward to serving you. 03870 per 100 Assessed Valuation.

We are committed to treating every property owner fairly and to providing clear accurate and timely information. Pay your current or past real estate taxes online. Local governments then tax that assessed value of items such as cars campers and boats.

If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. May 15th - 1st Half Real Estate and Personal Property Taxes are due. Online declarations are available no later than the last day of January through April 1 of.

November 15th - 2nd Half Agricultural Property Taxes are due. Residential Real Property Tax Rate. Where Do I Pay County Personal Property Taxes St Louis County Personal Property Tax.

All City of St. Pay your personal property taxes online. Your feedback was not sent.

Louis County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802 218 726-2380. All that real property in st louis county minnesota described as follows.

Louis MO 63103-2895 Phone. Central Ave Clayton Missouri 63105 2nd floor. Louis City Hall Room 109 1200 Market Street St.

03340 per 100 Assessed Valuation. Louis County is 223800 per year based on a median home value of 17930000 and a median effective property tax rate of 125 of property value.

How Healthy Is St Louis County Missouri Us News Healthiest Communities

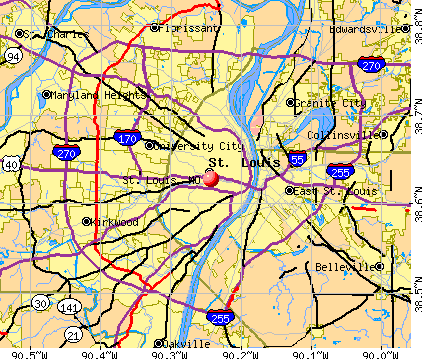

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Revenue St Louis County Website

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

Action Plan For Walking And Biking St Louis County Website

How Healthy Is St Louis County Minnesota Us News Healthiest Communities

Simplifying The Market Jarnell Carter Posh Properties Stl St Louis Metroplex Mo 314 441 1012 Housing Market Buying Your First Home Real Estate Buyers

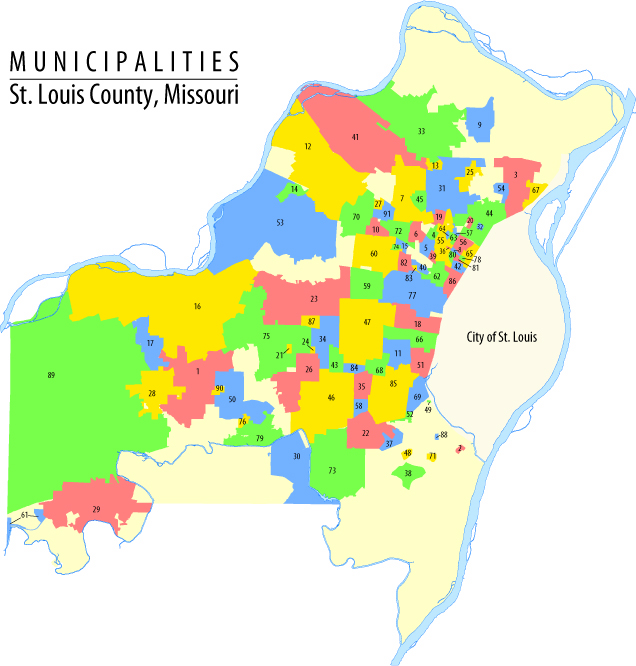

Townships St Louis County Website

Stl Area Misconceptions Treaty

2022 Best Neighborhoods To Live In St Louis Area Niche

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

Powered By Expert Realtors Creve Coeur Ladue Stl

The Best And Worst Cities To Own Investment Property Investing Investment Property City